The figures that directors Drea Cooper and Zackary Canepari assemble as talking heads for their documentary assault the viewer Greek Chorus-style, outlining a compelling, smothering, and effective picture of amateur investors stumbling upon the stock market as one might a church or guru. “Diamond Hands: The Legend of WallStreetBets” spends just 84 minutes telling a tight and surprisingly nuanced story that never veers into outright mythmaking — despite several of its subjects’ best efforts — pulling up just short of a more interesting examination of a much larger system. For most, the smash-cuts, grievance monologues, and meme literacy will be enough to flesh out the narrow story Cooper and Canepari try to tell, yet “Diamond Hands,” ironically, doesn’t cut that deep.

READ MORE: 2022 SXSW Film Festival: 15 Must-See Film & TV Projects

The documentary starts in March 2020, using the onset of COVID-19 as a narrative baseline for its story. Although “Diamond Hands” makes good use of several professional investors and finance professionals, its core group of talking heads is a rogue’s gallery of amateur traders like photographer Chris Garcia, retired military diver Matt Kelly, and physical fitness enthusiast Alisha B. Woods. These speakers talk about the ways the pandemic upended their lives (and financial situations). Then, encouraged and inspired by varying degrees of intuition, intellect, courage, moxie, spite, and desperation, they and many like them started playing the market with their stimulus money.

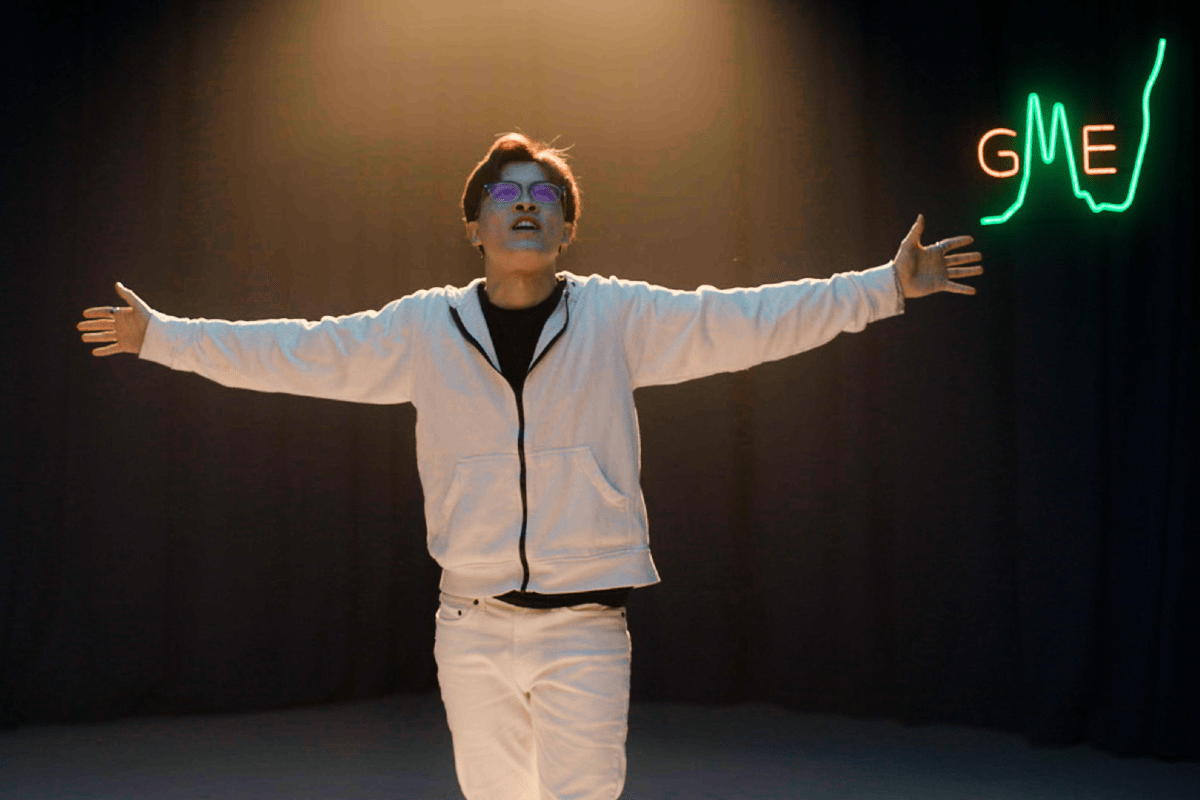

However, it wasn’t just the amateur shoot-from-the-hip investors that shaped this story. A growing subsection of sharp-eyed financiers saw that several big hedge funds were “shorting” Game Stop (GME), a brick-and-mortar video game retailer that was trading at about $20 a share in the last weeks of 2020. Buying GME stock was a wager against these hedge funds, whose “short” positions cashed in if the stock went down. This allowed small-time investors to not only bet against the big boys but bankrupt them if enough like-minded people joined the cause. By the beginning of 2021, these disparate forces seemed to find a voice in a Reddit forum, r/wallstreetbets, which informally organized as a semi-united force devoted to pumping up the GME stock price (and taking down “the system”).

Anyone following the news over the last year in even a tangential way knows what happened next. “Diamond Hands” does a marvelous job unpacking exactly how things went from boom to bust for people like Chris, Matt, and Alisha. After an astronomical surge in the GME stock price (upwards of $460/share), one of the most popular trading apps, Robinhood, restricted buying, sending the stock into freefall. At this point, all the individual, small-time investors cried foul, prompting accusations that someone had rigged the system to shift power back into the hands of the big hedge fund players.

Cooper and Canepari pull off an interesting trick, lifting the curtain on this story to reveal how the supposed genius and bravery of people like Alisha, Matt, and Chris was little more than good-natured hubris. Indeed, there was never any scenario where Wall Street and “the system” — nebulous boogeyman that it is — was going to let an army of small-time investors rock the boat. So as quickly as it began, the investing revolution led by Reddit’s proletariat seemed to fizzle.

In this way, “Diamond Hands” tells a “new” story that is only novel in its technological particulars. Rogue, outside investors getting screwed by the government, regulatory bodies, and Wall Street is nothing new (Christ, didn’t anybody else watch “The Big Short!?”). This documentary weaves a fascinating web of intrigue, sure, but its failure lies in its inability or unwillingness to contextualize this Game Stop event within the larger fabric of both American finances and human character.

For Alisha, Matt, and Chris, it is obvious that the events of the last year-plus don’t just represent a financial position for them, but a new lifestyle: a revised worldview. And this is what is interesting here — and, sadly, underexplored. Alisha, Matt, and Chris are real people. They earnestly believe “the system” is driving them into high-risk-reward scenarios just to survive. Is this a broader social phenomenon outside of this subset of smartphone app investors, and has it influenced the market or American society in any other sectors?

Although this story is still being written — many developments covered are just a year old — more input from social scientists, labor market experts, and historians would have contextualized this and provided some much-needed perspective. Even so, it’s a slick and efficient snapshot of riveting financial history that emphasizes a bottom-up perspective in a genre dominated by the tops. Compelling, yet lacking a broader perspective that would have elevated this from book report to a serious and groundbreaking new dialogue, “Diamond Hands” follows the lead of its most vocal subjects: in fast, out faster, and utterly out of its league in a scenario where it could make a difference. [B-]

Follow along for our complete coverage from the 2022 SXSW Film Festival.